While much recent housing data shows declines in home building and buying across the country, at least one section of the market appears to be climbing counter the current: building material prices.

The Good and Bad in Housing Data

In October, total exhisting home sales, including single-family homes, townhomes, condominiums and co-ops, were 28.4% lower than they were the year prior, according to the National Association of Realtors. In the same month, the National Association of Home Builders reported that overall housing starts had fallen 4.2%, and that year to date, single-family starts are down 7.1%. "This will be the first year since 2011 to post a calendar year decline for single-family starts," wrote Robert Dietz, NAHB's chief economist.

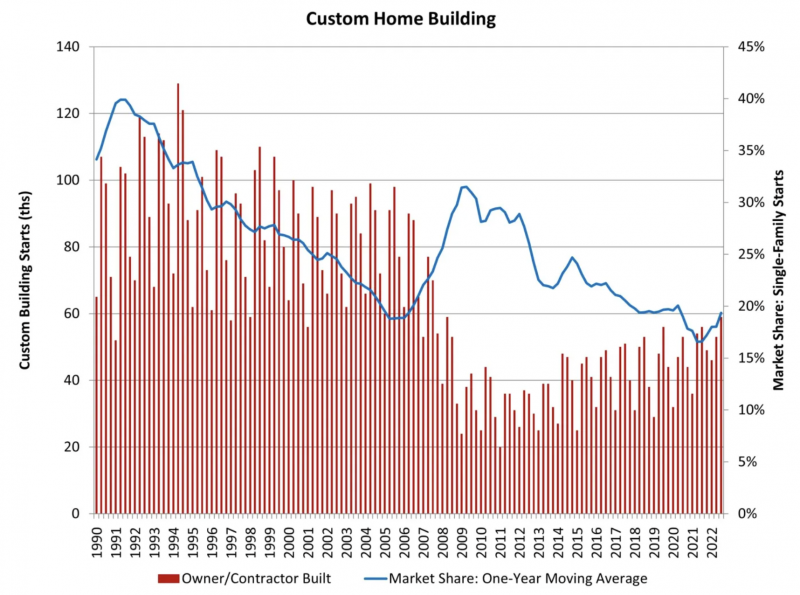

Source: National Association of Home Builders

Builder confidence has declined for 11 straight months, as of this November.

But there are bright spots in the market. The nation's labor pool in October officially reached pre-pandemic levels, following a year-over-year increase of 5.3 million jobs, which included a 3.6% increase in construction jobs, according to the Bureau of Labor Statistics. This year's third quarter saw 59,000 custom building starts, a 14-year high, according to NAHB. And as mentioned above, building material prices are improving.

Building Materials Prices Fall Again

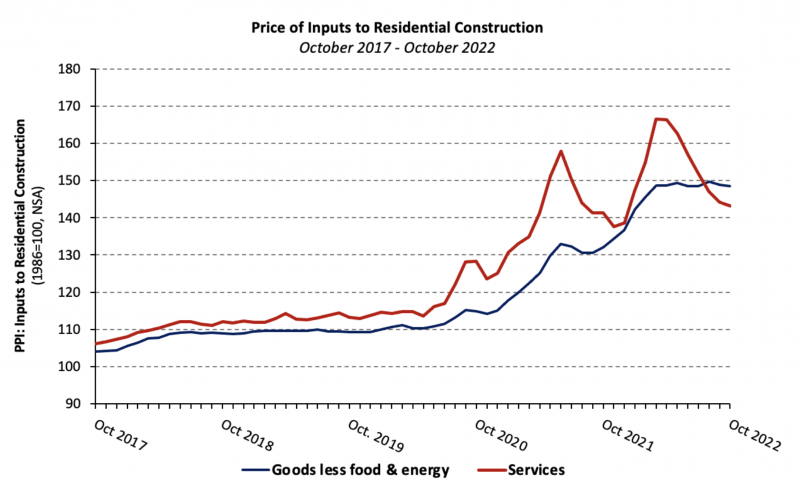

In October, the Producer Price Index showed that building material prices had declined for the second consecutive month.

Source: National Association of Home Builders

Prices of indiviual materials, of course, vary, as an NAHB breakdown of PPI data revealed.

Some materials are still climbing in price. The PPI for gypsum, for instance, despite a 0.2% decrease in October—the first monthly decline in price since September 2020—is 45.6% higher than it was in January 2020. And overall ready-mix concrete prices actually increased 0.4% in October, and have risen 9.1% year to date (the largest YTD increase ever recorded).

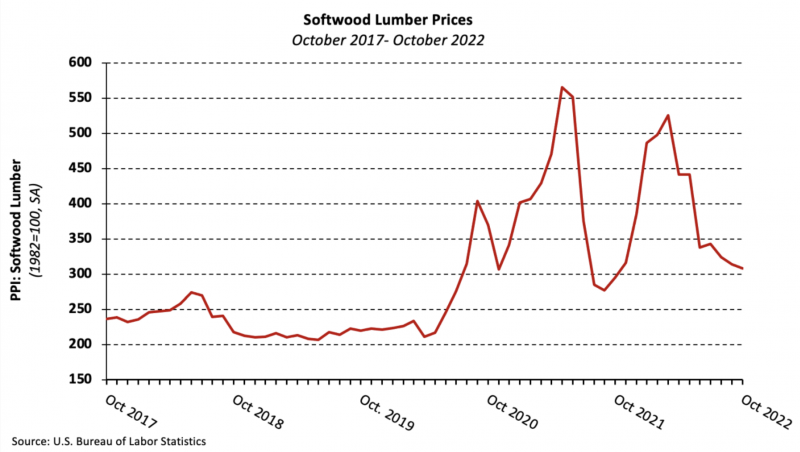

But other materials are seeing significant drops. Softwood lumber prices fell 1.7% in October, marking three straight months of decline. And while softwood lumber prices do remain 4.4% higher than the same time last year, they've fallen 41.3% since March of this year.

Source: National Association of Home Builders

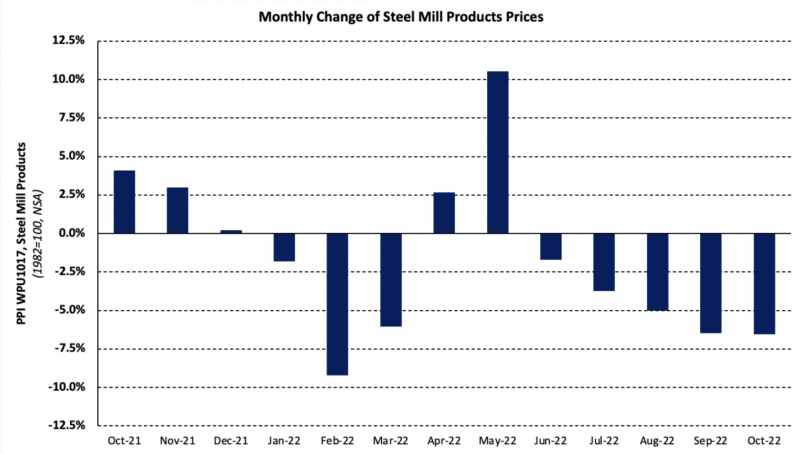

After five consecutive months of price declines, each larger than the last, the PPI for steel mill products is at its lowest level since May 2021. Prices for the products decreased 6.6% in October and since May of this year have declined 21.6%, according to NAHB.

Add new comment