Deck builder Tim Stephens has watched his customers make “almost a complete reversal” since the peak of the recession, when money-conscious homeowners were choosing wood decks almost exclusively and eschewing costlier composites.

“People were putting their money into the size of the deck and not the material,” says Stephens, owner of Archadeck of West Central and Southwest Ohio. “We were doing 15 percent or 20 percent composite. People were going with wood for the most part.”

A couple of years ago, they flip-flopped, Stephens says. Today, 85 percent of the Waynesville, Ohio-based company’s sales are for composites. “People have changed,” he continues. “It’s not about the money anymore; it’s about time. People don’t want to be spending their free time out maintaining a wooden deck.”

Stephens’ experience isn’t unique. Pressure-treated wood remains dominant, but demand for composites is growing faster than the decking industry average, according to Malvern, Pa.-based Principia Consulting’s “Residential Decking and Railing 2015” report.

Others in the industry point to synthetic decking’s low maintenance requirements as a reason composite’s market share, which sank significantly after the crash, is projected to grow by 5 percent a year through 2017, compared with 3 percent overall for the $4.1 billion decking and railing industry. “As Baby Boomers get older,” notes Mike Beaudry, executive vice president of the North American Deck and Railing Association, “we don’t want to stain and sand.”

Plus, says Steve Van Kouteren, a principal at Principia, low unemployment and increasing wages have bolstered consumer confidence. That has translated into more home sales, an increase in household formations, and extra spending money.

Deck size is increasing, as well, says Brent Gwatney, senior vice president of sales and marketing for MoistureShield. “There’s no 12-by-16-[foot decks] anymore,” he explains. “They’re building decks with areas for an outdoor kitchen, for lying in the sun, for entertaining.” And larger decks require boards with longer spans, another reason “why we see a more dramatic turn toward composites at the high end.”

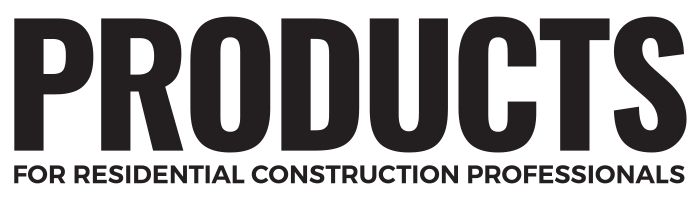

Within three years, Van Kouteren predicts, composites are likely to reclaim the historic 20 percent market share they enjoyed pre-recession. Capped boards, Principia research reveals, account for 70 percent of synthetic sales, up from 40 percent in 2012. Uncapped products, which also claimed 40 percent of the market in 2012, slid to 10 percent since then. Higher-priced, wood-free cellular PVC decking, also more popular pre-recession, is expected to settle in at between 15 percent and 18 percent of the market, down from about 20 percent as homeowners continue to embrace capped composites.

“Capped is king,” says Stephens. “We do offer just a straight [uncapped] composite board, but everything I’ve sold in the last three years, it’s all been capped,” he says, even though the upgrade can add more than $1,000 to the cost of a $20,000 deck. The researchers at Principia agree: “Capped decking,” the report notes, “provides the industry with a product that offers true low maintenance features at a variety of price points and aesthetic choices.”

Those choices include tons of options: colors; boards that bend and curve; and railings, lights, and accessories that coordinate with the decking.

Still, the amenities come at a price. The Principia report notes that much of the growth in the composite decking sector is at higher price points, which “could limit growth opportunities for the upper end of the … market.”

To counter any reluctance among consumers to invest in composites, the industry will step up its efforts to inform the public about the product’s benefits. “Consumers just look at the wood up front and think it looks nice, but they don’t see what happens over time,” says Adam Zambanini, vice president of marketing for Trex. “We’ll be educating them.”

This story originally appeared in the Spring 2016 issue of PRODUCTS magazine. See the print version here.

Add new comment