While the current interest rate environment and stubbornly high home prices continue to present near-term challenges for homeowners, cooling inflation and the expectation of interest rate cuts set the groundwork for a strong year in the residential repair and remodel and new construction market. BGL’s active dialogue with many of the industry’s leading companies at the 2024 International Builders’ Show confirmed this sentiment, and underpinning this optimism is a renewed appetite for accretive acquisitions.

Notable Industry Transactions

Following a quiet 2023, strategic buyers are back in the market for M&A. In the first two months of 2024, two hallmark deals have already been announced at meaningful premiums.

In January, MITER, a nationwide manufacturer of precision-built windows and doors, announced a definitive merger agreement to acquire PGT Innovations, a manufacturer of premium impact-rated windows and doors, for an enterprise value of $3.1 billion, a 60% premium to its stock price the day prior to the announcement.

“The combined company will continue its long-held commitment to innovation, service, and high-quality window and door products as we accelerate our growth trajectory,” said Matt DeSoto, president and CEO of MITER, in a statement.

In February, Owens Corning, a manufacturer of roofing, insulation, and composite materials, announced the acquisition of Masonite, a leading global provider of interior and exterior doors and door systems, for $3.9 billion, a 38% premium to its stock price the day prior to the announcement. The acquisition of Masonite adds a highly complementary line of innovative products and advances Owens Corning’s strategy to expand its building materials offering in residential applications. Recently, Mohawk announced M&A as part of its long-term growth strategy, with the company stating, it is actively looking for add-on acquisitions and is ready to enter new geographies.

These deal announcements will serve as a catalyst for broader M&A—a signal to the market that industry participants on the frontline are confident in the long-term outlook to purchase large assets at meaningful premiums. Geographic expansion, product innovation, and cost synergies will remain key drivers for consolidation.

As we look to the outlook for the balance of 2024, we expect buyer sentiment in the broader building products industry to continue to improve, with companies looking at acquisitions to accelerate their growth trajectory and add innovative new products into their portfolio. These transactions underscore their strong conviction about the long-term prospects for both the residential new construction and R&R markets.

Consumers Signal Strong Desire to Invest in Their Existing Homes

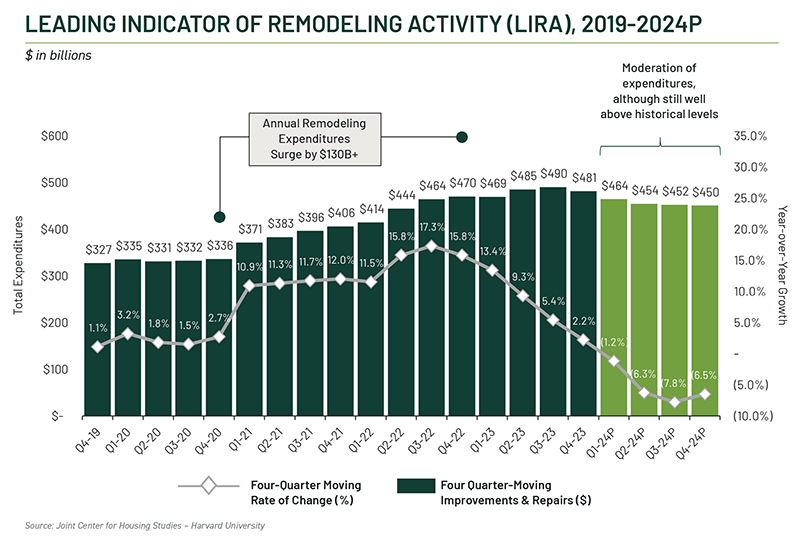

While repair and remodel activity is projected to fall from $481 billion in 2023 to $450 billion in 2024, this still represents a healthy level of activity, according to the Joint Center for Housing Studies at Harvard University. With home prices and mortgage rates continuing to remain elevated, many consumers are turning to near-term repair and remodeling projects. This, in conjunction with an aging housing stock of new homes built during the years leading up to the Great Recession and now entering their prime remodeling age, is expected to support long-term tailwinds within the market.

Supporting the R&R market, the long-term outlook for residential new construction has continued to show greater resiliency than expected with many anticipating the second half of 2024 to kick start growth. Tailwinds such as an unprecedented demand for affordable housing and improving inventory levels will shrink the gap between supply and demand.

The building products industry is set for long-term growth, and buyers are beginning to test the markets seeking to benefit from a first mover advantage. Recent high-profile mergers have signaled that there’s appetite from both buyers and sellers. While the current housing market is still working through temporary affordability challenges, pent-up demand for affordable housing continues to grow. As interest rates begin to moderate in 2024, BGL expects this to provide the tailwinds needed to support a multi-year growth outlook for new construction and repair and remodeling markets.

Andrew K. Petryk is a managing director and leads the Industrials practice at Brown Gibbons Lang & Co., an investment banking and corporate financial advisory services firm serving the global middle market. Reach him at apetryk@bglco.com.

Add new comment