Every year for the past four years, The Farnsworth Group and Venveo have partnered to bring together sales and marketing leaders from the U.S. and Canada’s top building product manufacturers and suppliers. For two days, event attendees hear from industry economists, experts, and insiders who share research, data, and insights on not just the building products industry but on residential construction at large. The event is called the Building Products Customer Workshop.

This year, Pro Builder Media—which includes the Pro Builder, Custom Builder, and PRODUCTS brands—was invited to take a peek behind the curtain to hear and share in both the information being presented by speakers and panelists as well as the discussions being had by attendees. Here's what we learned.

Residential Pros Have Been Changing Suppliers and Brands, and Enjoying It

Something that came up a lot at this year’s Workshop was change: pros are changing in a changing industry that serves a changing market in an economy in change. Some of the information reaffirmed changes we were already seeing—like that permits for new construction are falling around the country and remodeling spending is expected to drop significantly by Q4 2024. Other information revealed changes that, at least to this editor, were novel. One thing in particular that stood out was residential construction professionals’ seemingly newfound partiality for changing building product suppliers and brands.

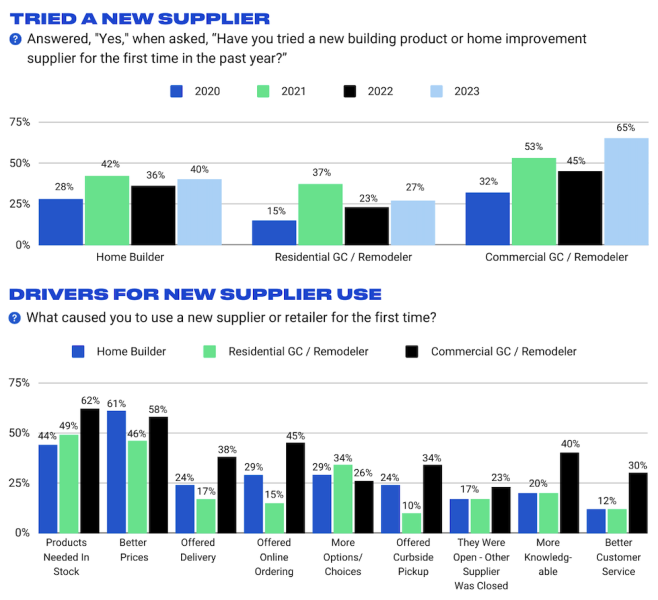

While price and availability topped the list of new supplier drivers for builders and remodelers, plenty of other factors played a role in those decisions.

In 2020, 28% of home builders, 15% of remodelers, and 22% of specialty trade contractors (not shown) admitted to trying a new building products supplier, according to data presented by The Farnsworth Group and Venveo. A year into the pandemic, and a year into crippling supply chain disruptions, residential construction pros were, not surprisingly, more willing to try a new supplier. In 2021, 42% of builders, 37% of remodelers, and 34% of specialty contractors admitted to trying a new product supplier. What is surprising is that today, with building product supply chains having somewhat stabilized, builders, remodelers and specialty contractors are still reporting heightened levels of supplier fluency, with 40%, 27%, and 34%, respectively, admitted to having tried a new supplier this year.

Brand fluency was also a topic of some discussion at the Workshop. The consensus among presenters and attendees alike was that, historically, residential construction professionals had been consistently loyal to building product brands but in recent years have been increasingly willing to try a change. What’s more, those who made a change were happy they did.

Ninety-four percent of residential pros that tried a new brand within the last year were at least “somewhat satisfied” with the experience, and more than half (51%) were reportedly “extremely satisfied.” About 96% of those that tried a new brand also said that it performed, at minimum, the “same” as their normal brand, with two-thirds admitting the new product actually performed better.

“Historically, contractors are not change agents,” said Grant Farnsworth, president of The Farnsworth Group and one of the event’s emcees. “But there is an argument to be made that over the last few years these contractors became okay with change.”

Manufacturers Feel a Sense of Urgency

During one of the Workshop’s presentations, there was a comment from the crowd of manufacturer and supplier sales and marketing leaders that really stuck with me: “Sales reps are struggling with prospecting because in recent years we didn’t need to focus on bringing in more clients.” It struck a chord with the audience, too, who began agreeing and then sharing. One person lamented the growing need for marketing at a time when many manufacturers and suppliers have spent the last three years slashing marketing budgets. Another described a solution in which their company had expanded its inside sales team to remove some of the administrative burden on reps in the field.

Ultimately, the discussion boiled down to something Farnsworth said: “Manufacturers need to get back to a competitive mindset. Nowhere in the data does it show that manufacturers can be complacent and win customers. They need to be competitive.”

Manufacturers and Suppliers Alike Are Rethinking “Value”

Part of what Farnsworth meant when he said “competitive” is that manufacturers as well as suppliers need to be reevaluating their value proposition. In a presentation on contractor buying habits by Steve Swinney, the founder and CEO of Kodiak Building Partners, that very point was addressed.

“Contractors are feeling better about supply chain issues, but they’re concerned about finding qualified people, inflation, mortgage rates, and permitting issues,” said Swinney. “What they want from manufacturers and suppliers is pricing consistency, communication, and flexibility in their supply chain.”

Kodiak Building Partners is a portfolio of building product suppliers that provide residential construction professionals with a wide variety of products including appliances, doors and windows, lumber, hardware, and more. The company did $3 billion in sales last year. So when Swinney talked about buying habits, he was talking from experience.

“While manufacturers can’t supply contractors with labor, they can provide additional value to make the job easier,” he said. “They could be making the sales process easier or faster. They could be better and quicker with communication. And they can include labor-saving features on product.”

The room agreed. Deanna Murphy, director of strategy at Venveo, said that manufacturers and suppliers are going to need outreach that is “multi-channel and never stops.” She used Delta Faucet as an example of a brand with a particularly good online buying experience.

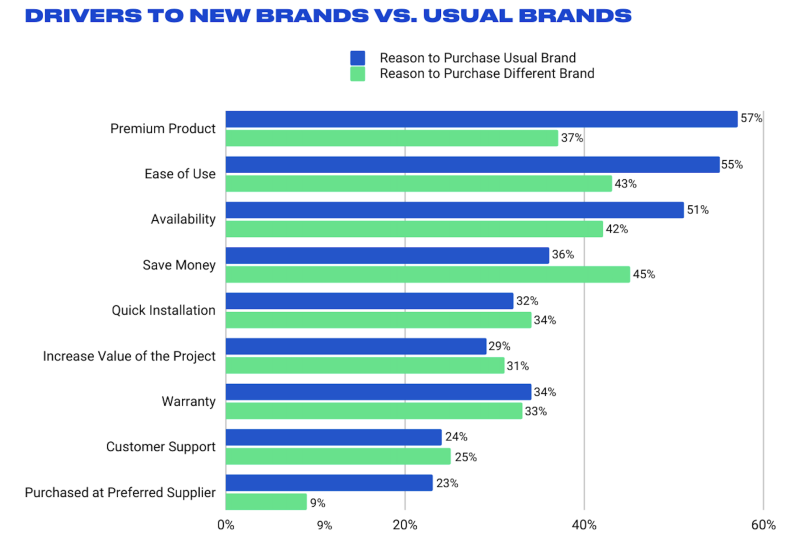

Price plays a much bigger role in selecting a new brand than it does in deciding to stay with an old, which suggests that builders and remodelers require more from a manufacturer than a good price to stay loyal.

Berth PopNikolov, CEO of Venveo and the event’s other emcee, emphasized the need, especially among architects and designers, for exceptional manufacturer and supplier sales reps. “Even for younger architects, they need reps to be a part of the process,” said PopNikolov. “They need to be able to pick up the phone and discuss the project with someone that they can tell knows what they’re talking about.”

And when the question of price came up, Farnsworth put it simply, saying, “If everything else is the same, price is the determining factor.” Which is to say, price won't always be enough.

Manufacturers and Suppliers Are Looking for Labor Solutions

One of the areas where manufacturers and suppliers seem to have an opportunity is labor. “Construction spending is outpacing construction employment,” Swinney of Kodiak Building Partners said. But as much as it may be an opportunity for producing labor-saving products and/or streamlining sales processes, it’s also an opportunity to help a long-term challenge for the industry they serve. Though, it won’t be so easily solved.

Danushka Nanayakkar, assistant vice president of forecasting and analysis for the National Association of Home Builders, said in her presentation on the housing economy that builders would need to build roughly 1.2 million homes a year, every year from 2025 to 2030 to get the nation out of its current housing deficit. "Skilled labor is going to be a big problem," she added.

While labor isn't an express responisbility of building product manufacutrers and suppliers, it was clear that those in the room—presenters and attendees alike—felt at least some degree of obligation to help address the labor situation at large.

"We need to get creative to pull younger people into the trades," Venveo's Murphy said on stage.

Murphy's comment was met by an audience of nodding heads and agreeing sentiments. You could hear discussions of training programs for installers, scholarships for vocational programs, and outreach to high schoolers and college students to educate them on the earning potential of construction pros. The group's discussion on labor, much like the many other topics and issues brought up during the Workshop, revealed a style of thinking from manufacturers and suppliers that suggests a hollistic, connected view of the building products industry in relation to the issues of housing and construction. The impression it left was, "they're as much our problems as theirs."

Add new comment